Breakdown of some important taxes you need to pay

We encounter taxes every day, and there are a number of taxes for different situations and people. For starters, we will list some of the most common taxes that most people will need to pay:

- Federal income tax & State income tax

Income tax is one of the most common taxes in the United States it is imposed by the federal government (thus called federal income tax), and most states (called state income tax). Income tax is imposed on the net income of individuals, corporations, estates, and trusts.

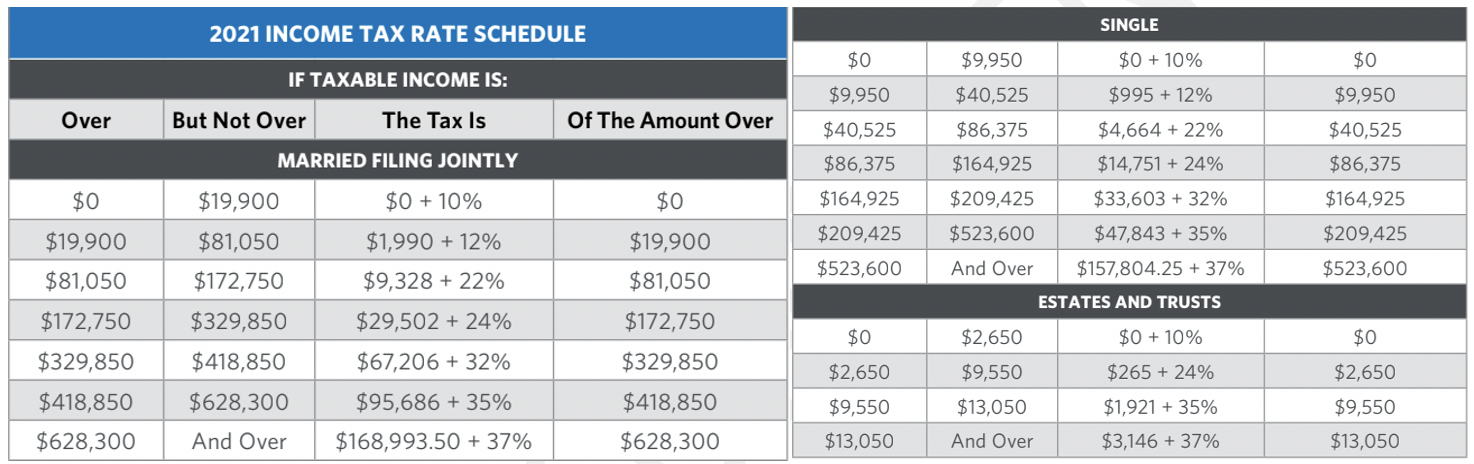

The income taxes are determined by applying a tax rate, which may increase as taxable income increases. For the 2021 tax year, there are seven tax brackets for most ordinary incomes: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Generally, as you move up the paycheck scale, you also move up the tax scale. Your tax bracket also depends on your taxable income and your filing status : single, married filing jointly or qualifying widow(er), etc.

- Employment tax

Employment taxes are federal and state taxes related to employee's taxable compensation, including the employees' share of Social Security and Medicare taxes (FICA). The current tax rate for Social Security is 6.2% for the employer and 6.2% for the employee, for a total of 12.4%. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, for a total of 2.9%.

- Sales tax

This is a type of taxes that everyone will see on a daily basis for the sales of certain goods and services. In U.S., laws allow the seller to collect so-called traditional sales tax from the consumer at the point of purchase that's why you can see "sales tax" on almost every bill of your daily life, whether it's dinner, grocery or a cup of boba tea. Conventional or retail sales taxes are only charged to the end users. The sales tax rate in different states and even different counties varies sometimes by a lot.

- Capital gains tax

A capital gains tax is on the profit realized on the sale of a non-inventory asset. The most common examples are stocks, bonds, precious metals, real estate, or other properties.

- Dividend tax

Dividend income is taxable but is taxed in different ways depending on whether the dividends are qualified or nonqualified.

Qualified dividends, which include those paid by U.S. companies, are taxed at the long-term capital gains rate. Qualified dividends are tax-free for individuals in the 10%, 12%, and 22% tax brackets (or those earning less than $80,000 per year). For taxpayers (regardless of your tax filing status) in the 22%, 24%, 32%, and 35% tax brackets, qualified dividends receive a 15% tax rate. Qualified dividends are taxed at a 20% rate for taxpayers (regardless of your tax filing status) whose income falls in either the 35% or 37% tax bracket.

On the other hand, nonqualified (also called ordinary) dividends, such as those paid by real estate investment trusts (REITs), are taxed at the regular income rate.

- Luxury tax

This is a tax on luxury products (not considered essential). A luxury tax may be modeled after a sales tax or value-added tax (VAT), charged as a percentage on all items of particular classes, such as expensive cars, jewelry, etc.

- Property tax

If you have a real estate property, you must be familiar with property tax - it is a tax on property owned by an individual or other legal entity (such as a corporation).

Except for the taxes introduced in the previous chapter, which are common and well-known, there are also some taxes that many people may NOT notice or pay enough attention to, such as:

- Estate tax

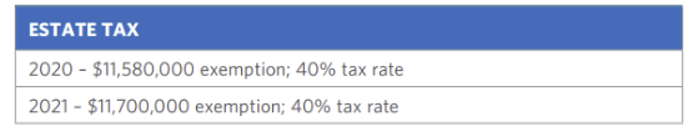

The estate tax is on a person's assets after death. In 2021, federal estate tax generally applies to assets over $11.7 million. In 2022, it rises to $12.06 million. Estate tax rate ranges from 18% to 40%. Especially for non-resident aliens, estate tax exemption is only $60,000, instead of $12.06 million! Therefore, for non-U.S. citizens or foreigners without green cards , a life insurance with financial compensation will provide a solid backup and protection if anything undesirable happens.

-Gift tax

The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return. The tax applies whether or not the donor intends the transfer to be a gift. The gift tax applies to the transfer by gift of any type of property (including money).

There are exemptions from having to pay gift taxes. For example, gifts up to a certain value per year per recipient are subject to the annual exclusion. In the United States, currently the amount limit is $15,000.

Besides, there are also phone tax, fuel & gasoline tax, misc taxes (for miscellaneous income) etc. All these taxes, together, make "taxes" as the largest expense of an average U.S. family.

As we suggested in Finance 101, plan ahead! Working and receiving paychecks can generate incomes, but you need to manage your money let money make more money, or avoid paying taxes that you could have been exempt from.

Following this logic, one popular strategy is to use tax optimization to control your future tax burden. Tax optimization refers to the strategic allocation of assets among multiple investment accounts with varying taxation status taxable, tax deferred or tax advantage.

The general idea of tax optimization goes like this: you want to max out to tax advantage (tax-free) and minimize the taxes you have to pay (based on your specific circumstances and preferences), thus fueling your savings and preventing taxes from diminishing your savings more than necessary.

When you retire, you can also develop a sustainable withdrawal strategy with taxes usually with the help of a financial advisor. There is never an absolutely "correct" answer or solution for everyone, but you can always look to optimize your tax structure and minimize your tax burdens.

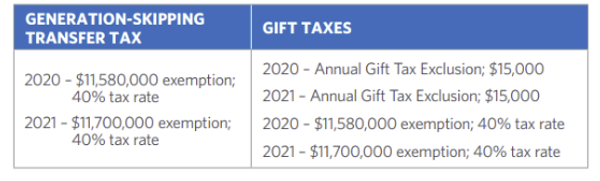

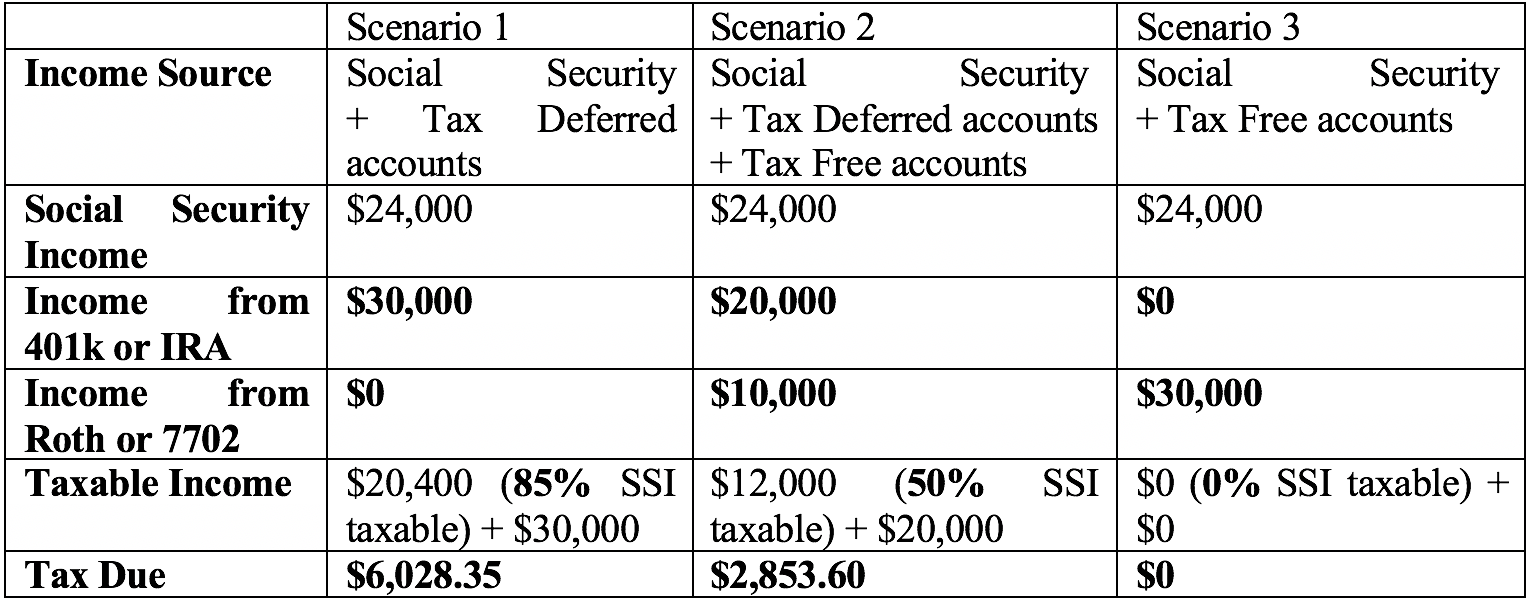

Tax optimization is best implemented as soon as can - the cost of not planning ahead can be really huge. For instance, if you scrutinize your paychecks, after you retire, depending on how much other "provisional income" you receive, your social security income maybe taxable (or maybe not, or partially taxable) and by optimizing your tax structure, you may be capable of saving a lot from tax-exempt benefits. Compare the following three scenarios:

From the calculation, you can tell that whether you utilizing plans like 410k/IRA/Roth-IRA/7702 makes an enormous difference, in terms of the taxes you need to pay. The reason lies in the different tax status brought by your asset/income source : income from 410(k) or traditional IRA is tax-deferred, while income from Roth IRA or 7702 is tax-exempt (tax advantage).

That's just the simplest example you can optimize these various types of tax-deferred/tax advantage programs and accounts, to minimize your taxes. As our articles go deeper, you will gain more insights on this topic.

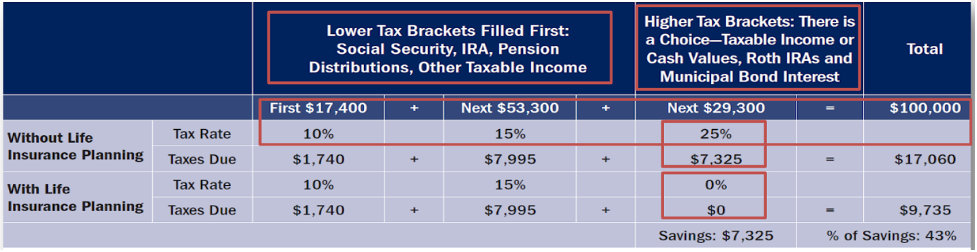

Also, whether you are equipping yourself with suitable tax-free investment income is significant. It is estimated that your tax burden saving can be 43% (as shown in the table below) - and the only difference is whether you plan ahead or not.

In the following articles, we will walk you through important option (investments, accounts etc.) for diversifying your taxable income sources: some are tax-deferred, and others are tax-exempt. Please follow our journey to "financial freedom" and start to compare & contrast to see what's best for you.