529 Plan

If you are planning for your children's future, and deem the expenses for education as one of the major concerns. The cost growth rate of attending a traditional four-year university has been rising more than twice as fast as inflation, about 7% per year.

You have probably heard about 529 Plan (also known as 529 College Savings Plans). It is a tax-exempt investment vehicle in the United States, designed to encourage saving for the future higher education expenses of a designated beneficiary.

You contribute money to a 529 plan and name a beneficiary of the account. Usually, the beneficiary is your child or grandchild, with the expectation that this account will pay for college education or other education - in fact, 529 savings plans aren't just for college. You can spend up to $10,000 from a 529 plan on tuition expenses for elementary, middle, or high school.

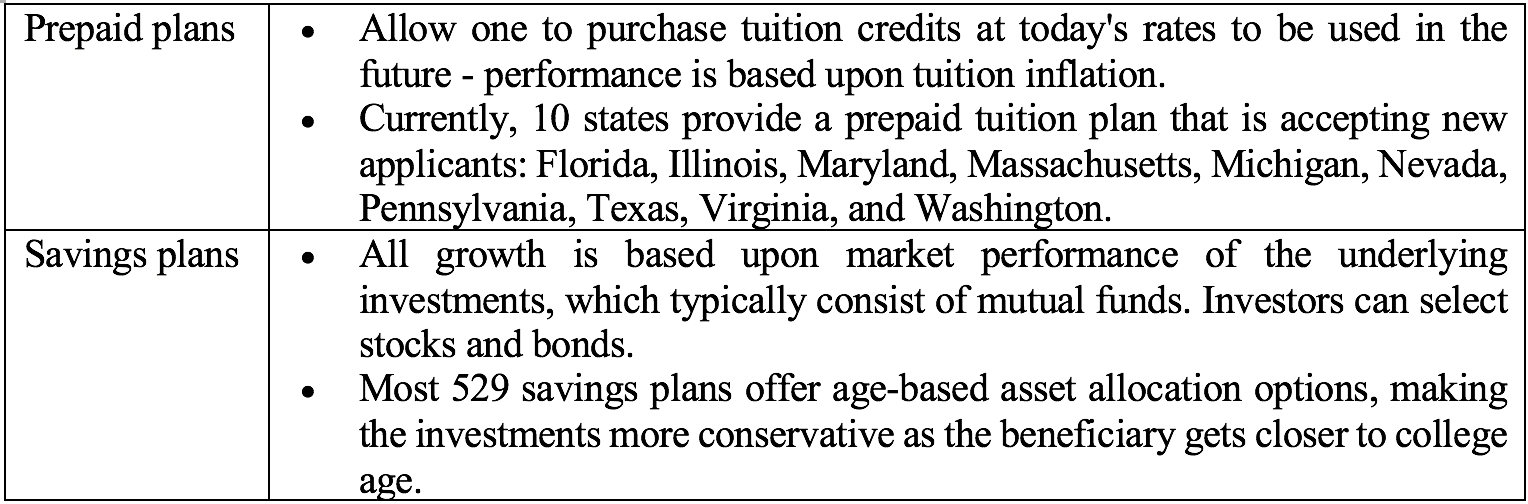

There are two types of 529 plans: prepaid plans and savings plans.

The primary benefit of the 529 Plan is that contributions to 529 college savings plans are made with after-tax dollars. Once money is invested in the account, it grows tax-free, and withdrawals from the plans are not taxed (no federal income tax, and generally no state income tax either) when the money is used for qualified educational expenses.

However, in the recent years, many investors are also feeling the disadvantages of 529 plans, such as:

1. Upfront costs are high

You're basically pre-paying for college credits out of pocket (Prepaid plan) or facing some costs for opening up the account (Savings plan).

2. It might influence** your child's need-based aid/loans/grants**

Paying qualified expenses directly from a 529 account that is owned by someone other than the student or parent may reduce the student's eligibility for need-based financial aid, loans or grants - if that's the case, what's the meaning of setting up the 529 accounts years before the kid goes to college?

3. You have little "control" over your investments

Money is strictly limited for use in education expenses, and there are penalties for non-educational or ill-timed withdrawals - otherwise, you will face income tax and an extra of 10% federal tax penalty.

When you use the money in a 529 account, your kid should be at least a half-time student. You can use the money to pay for tuition, fees, textbooks, room and board. Over the years, the definition of "qualified education expenses" has expanded and now includes pre-college education expenses (up to $10,000), as well as computer and internet expenses.

4. High limits of the total amount

There is a limit for how much money can be contributed per beneficiary in one year:

- $15,000/donor (per parent/grandparent)

- $30,000/couple

- $150,000 can be contributed per beneficiary in one year if married, filing jointly.

Probably due to the limitations above, stats show that 529 Plan has not been very popular. In 2013, only 2.5 percent of all families had 529 college savings accounts.