Traditional IRA

In the area of retirement savings, one of the most commonly seen term in the United States is "IRA", which means individual retirement account. In U.S., IRA is a form of pension provided by many financial institutions that provides tax benefits for retirement savings.

With the development of IRA, there have been several types of IRA in the United States: traditional IRA, SEP-IRA, SIMPLE-IRA, Roth-IRA. In this article, we will discuss the first three IRAs, and Roth-IRA will be covered in the upcoming article.

In terms of the return rate of IRA, there is no absolute value. The actual rate of return is largely dependent on the types of investments you select. According to the Standard & Poor's 500î (S&P 500î), from Jan. 1, 1971 to Dec. 31, 2020, the average percent an IRA grows each year is10.8 percent, whereas for the 10 years ending December 31st 2021, S&P 500î had an annual compounded rate of return of 13.6%, including reinvestment of dividends.

These rates can give you a glimpse of the expected return rate of an IRA, but are only reflections of the past few decades, and cannot guarantee anything for the future.

Traditional IRA

Traditional IRA (originally called Regular IRA) was established in the United States by the Employee Retirement Income Security Act of 1974 (ERISA). Generally, IRA is held at a custodian institution, such as:

- Banks

- Mutual fund companies

- Brokerage firms

- Life insurance companies

The only criterion for being eligible to contribute to a traditional IRA is that you have sufficient income to make the contribution. Contributions you make to a traditional IRA may be fully or partially tax deductible, depending on your filing status and income.

Generally, amounts in your traditional IRA (including earnings) are not taxed until you take a distribution (withdrawal) from your IRA. In other words, transactions in the account, including interest, dividends, and capital gains,are not subject to taxes while still in the account, but upon withdrawal from the account, you will be subject to federal income tax.

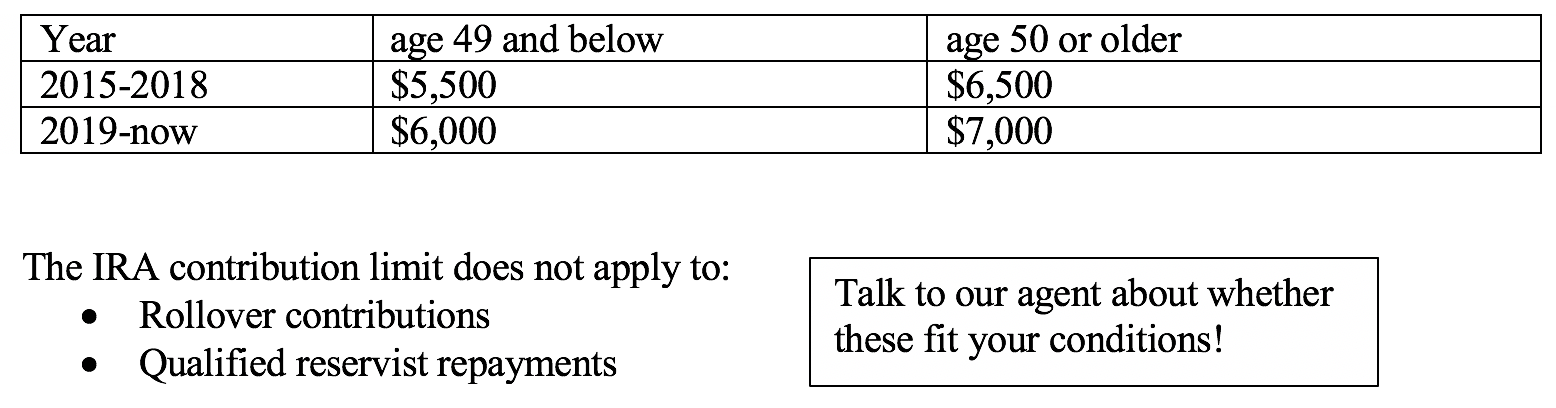

The amount of money you can contribute to a traditional IRA account always comes with an annual limit (yes, most IRAs have limits for contribution):

The primary benefit of the traditional IRA is like any tax-deferred savings plan: the amount of money available to invest is larger, compared to the case with a post-tax savings plan (such as a Roth IRA). This means that the multiplier effect of compound interest, or larger reinvested dividends, will yield a larger sum over time.

Besides, with a traditional IRA, you always have the flexibility to convert to a Roth-IRA; whereas a Roth-IRA cannot be converted back into a traditional IRA- you can choose an optimal (lowest tax rate) time to convert over your life. Because you have a right, but not an obligation, to convert - that's like an option in finance.

The disadvantages of a traditional IRA include strict eligibility requirements and a lack of liquidity. You must meet the eligibility requirements to qualify for these tax benefits: for instance, your income must be below a specific threshold for your specific filing status. But if your income (and thus tax rate) is that low, it might make more sense to pay taxes now (that's how Roth IRA works) rather than defer them (traditional IRA).

In terms of the age limit of traditional IRA contributions, for 2020 and later, there is no age limit on making regular contributions to traditional or Roth IRAs. For 2019, if you're 70 ý or older, you cannot make a regular contribution to a traditional IRA. However, you can still contribute to a Roth IRA and make rollover contributions to a Roth or traditional IRA regardless of your age.

Taxes on excess IRA contributions

If you are beyond the limit (whether the contribution or the age when you contribute), excess contributions are taxed at 6% per year for each year of the excess amounts remained in the IRA. An excess IRA contribution occurs if you:

- Contribute more than the contribution limit.

- Make a regular IRA contribution for 2019, or earlier, to a traditional IRA at age 70ý or older.

- Make an improper rollover contribution to an IRA.

Also,all withdrawals from a traditional IRA are included in gross income, which are subject to federal income tax(with the exception of any nondeductible contributions). This tax is in lieu of the original tax on employment income, which had been deferred in the year of the contribution.