Preparation for LTC: Insurance

Planning ahead for long-term care insurance can be seen as part of the retirement planning** - **it is something that young/middle-aged people should start to put on the agenda immediately.

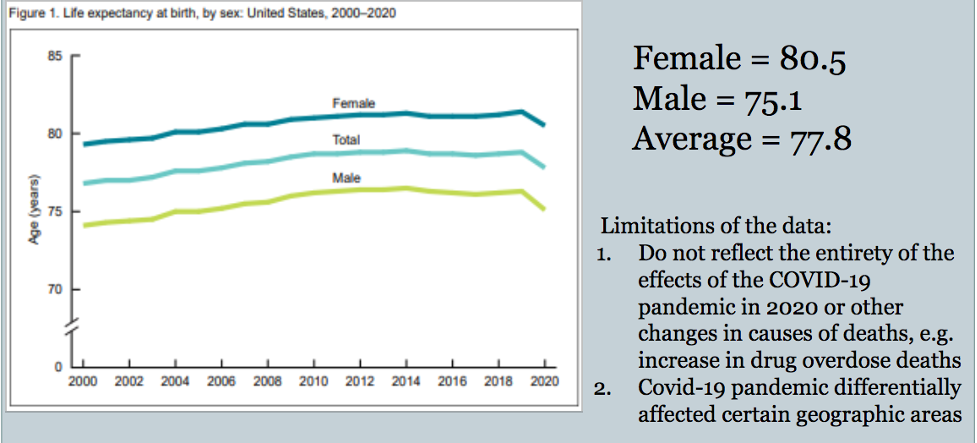

In particular, statistics show that women are 45% more likely to need long-term care, due to their higher life expectancy (80.5 years for women and 75.1 years for men). Therefore, planning LTC insurance in advance is even more important for women who are more risk-aware.

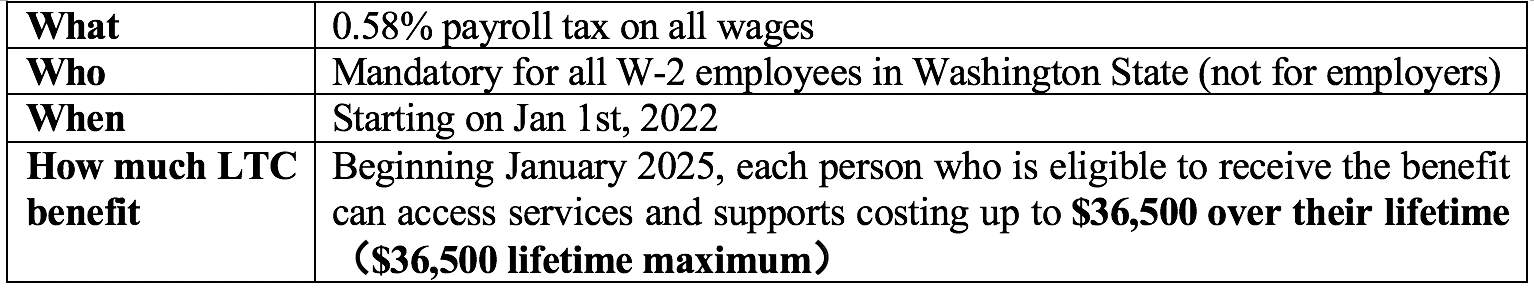

Washington State: LTSS Trust Law

In 2019, The Washington State Legislature established a long-term care insurance benefit for all eligible workers to address the future long-term care crisis - this is the first U**.**S state to establish a law about long-term care insurance. Below is a recap of the currently-adopted law (which may or may not be subject to changes in the near future):

Employees can choose to opt-out and exempt from paying this tax, with some criteria: Tax payer must have your own individual long-term care insurance policyzin place before November 1st, 2021.Submission of opt-out requests can start as early as Oct 1st 2021 for Private LTC insurance opt-out.

If the exemption is approved, individuals will not be required to pay this LTC tax, but will be permanently ineligible for benefits under the Program.

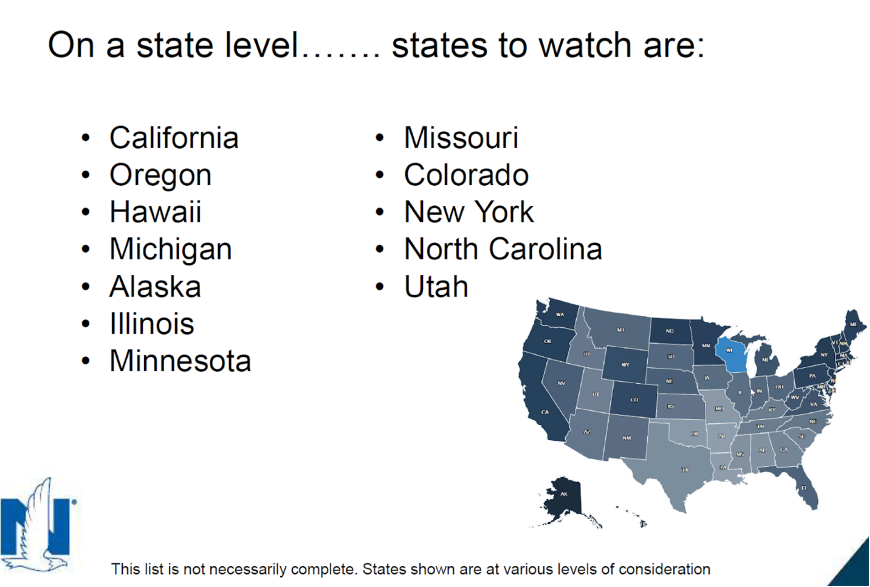

Aside from Washington State, many other U.S states are also considering about something similar: