Risk-return tradeoff

We all want to maximize returns and minimize risk in our investments. However, the relationship between risk and return is a tradeoff: a higher rate of return usually means higher risk. If an investment provides a high rate of return with relatively low risk, investors will flock into the "free lunch" and make the trade more expensive.

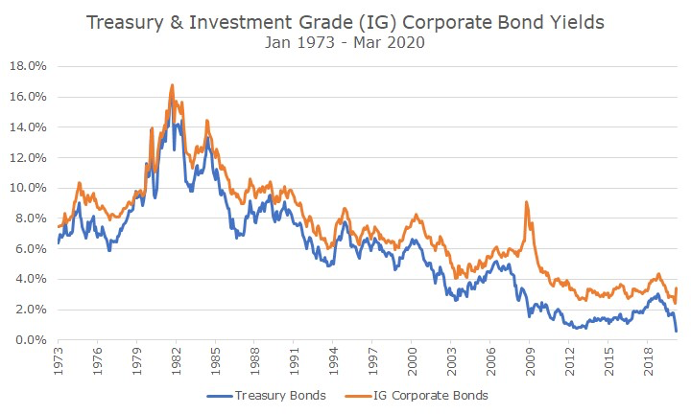

As a result, this investment will not be that profitable due to a higher cost. That is why we are not able to find an investment with low risk and a high return in an efficient market. An efficient market is one where all information is transmitted perfectly (everyone receives the information), completely (everyone receives the entire information), instantly (everyone receives the information at once), and for no cost (everyone receives the information for free). For the same reason, we can observe that the rate of return of treasury bonds is lower than corporate bonds because treasury bonds are free of default risks (See the chart below).

Even though treasury bonds are default risk-free, it does not mean that those conservative investments are totally risk-free. Those bond investors may still lose money due to interest rate fluctuations. That is to say, we cannot completely prevent the risk of losing money by choosing a "risk-free" deal. As an investor seeking robust and long-term returns, one thing we can do is to control our risks by using various financial strategies.

Impact of Loss

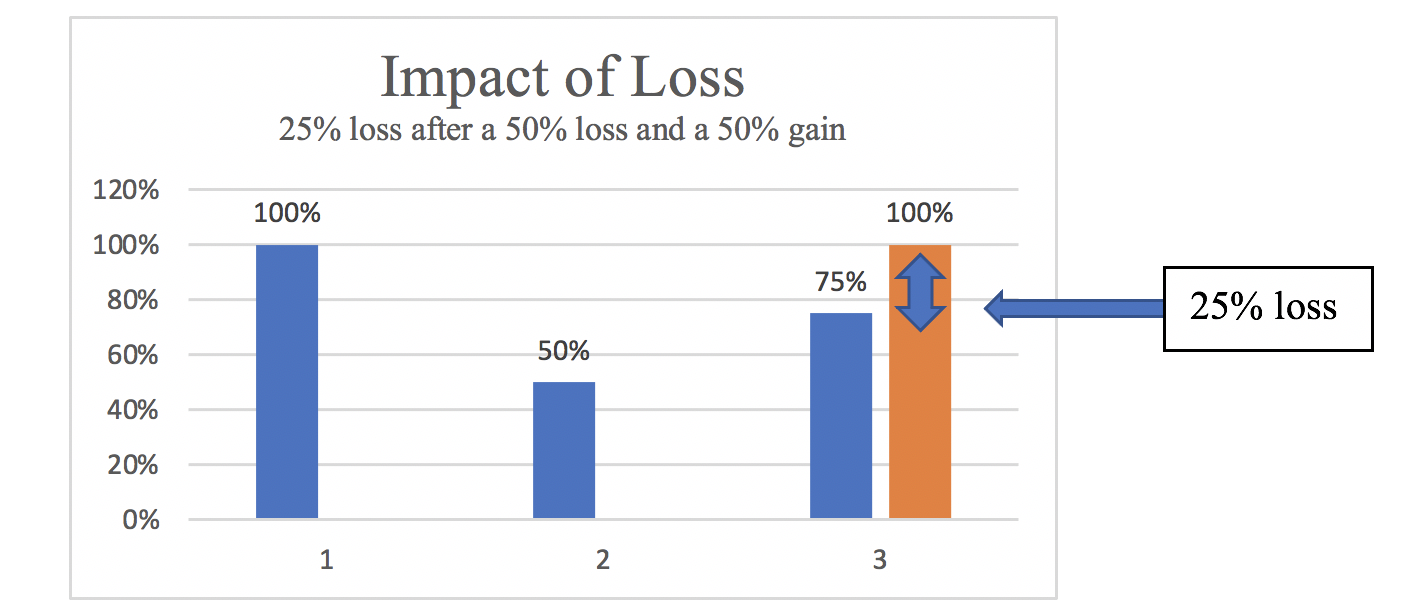

Moreover, the reason why we need to focus on risks is that the impact of loss is more significant than the impact of gain. Assume the price of a stock is $100 at the beginning. Unfortunately, the stock price drops to $50 after a stock market crash. In other words, it is a 50% loss.

Next, if we want to see the price goes back to $100, the price should be increased by $50, which will be a $50 ÷ $50 = 100% gain. As we can see, at least a 100% gain covers a 50% loss. Therefore, we must be more aware of risks because of the substantial impact of loss (See the chart above).

Manageable risks

The next question is: what kind of risks can we manage, and how could we minimalize the impact of loss? Finance 101 tells us that investment risks consist of systematic risks and unsystematic (idiosyncratic) risks: Systematic risk impacts on the whole market, such as interest rates. In an opposite, unsystematic risk only affects a particular sector of economy. For instance, if the authorities raise taxes on high-polluting industries, environmentally-friendly companies will not be harmed. That said, green tax is an unsystematic risk for high-polluting industries.

In other words, if we have different assets, systematic risk cannot be avoided. As an example, interest rate is the price of borrowing money. If the Fed decides to raise interest rates, all business will pay an additional cost of interest payments. So, everything will be more expensive, and the additional cost will impact on the whole market.

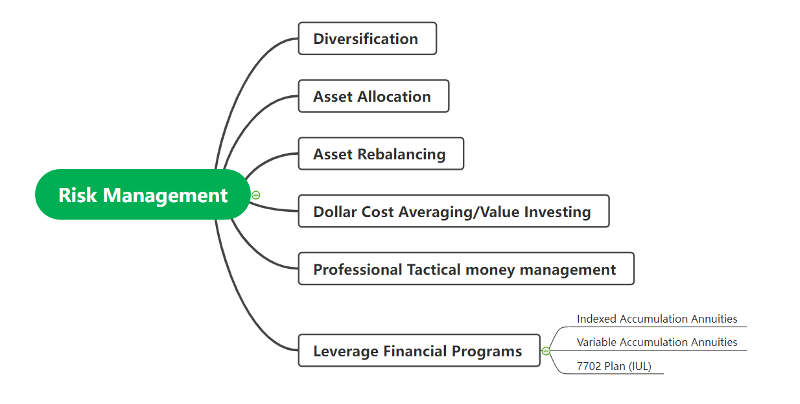

However, we can decrease unsystematic risks by implementing financial strategies and creating an efficient portfolio. In the next several articles, we will articulate those risk management strategies. That knowledge will help you succeed. Stay Tuned!